Some people are brilliant at budgeting and know their incoming and outgoing expenditures to the penny, other people have a rough idea of what comes in, what goes out and how much they have to play with each month whereas some people haven’t really got a clue and simply hope for the best. Talking about finances can be tricky, embarrassing and even depressing but it really shouldn’t be a taboo subject anymore. The more we talk about it the more we can help people and share resources and ideas about how to save, budget and get more for your money. When people talk about budgeting most people are guilty of imagining their stereotypical budgeter, be it person on a low income who has to budget to survive or a thrifty person who budgets to keep their money for themselves and wont pay for things but in reality loads of people budget, even rich people, they just don’t talk about it. In fact for lots of wealthy folk that it how they got so wealthy, by budgeting and investing carefully. So stop being embarrassed about wanting to be money savvy and start budgeting today by following our 5 top tips on how to budget.

Use a budget planner

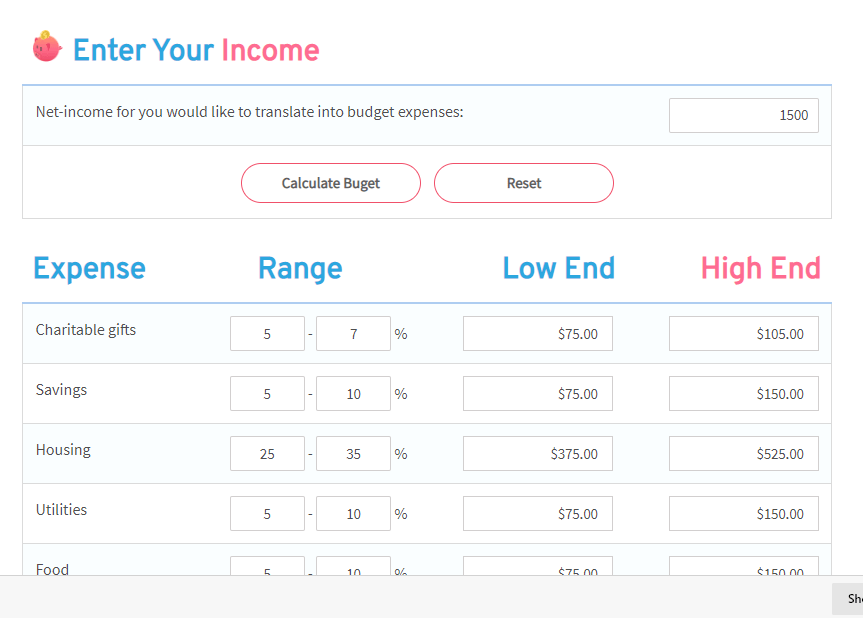

The first thing you need to do to start budgeting is to find a budget template that you can use. Pigly offer a free online budget calculator that is easy to use and, the best bit, it does the maths for you! It is crucial that you can clearly see the exact amount of money you have coming in each month and exactly what needs to go out. An effective budget calculator will then let you easily see how much money you have left and how you can then decide where that money is spent or saved. Once your budget is calculated you can clearly see if and where any changes can or need to be made. By having your finances all written down in one place you may be surprised by how much or how little you spend in certain areas, this will be a great a prompt for shopping around for things like insurance, mobile phones and energy suppliers to ensure you are getting the best deals.

Be honest

This sounds obvious but it is really important that you are honest with yourself about what you have coming in and exactly what you spend. If you like to buy a takeaway coffee everyday at work that’s fine but you need to be honest about these spending habits and include them by accounting for that money, those coffee’s, cakes or magazines quickly add up and if not accounted for your budget simply wont work. Budgeting isn’t about going without and saving every penny you have it is about being accountable for your spending, getting the most out for your money and being aware of your spending habits. So if you like to get your nails done, or treat your child/grandchild/niece or nephew to a few quid every week again that’s fine just make sure you add it to the right section on your budget.

Set Goals

Now that you have honestly completed your pigly budget calculator and have a clearer understanding of your finances set yourself some realistic goals. This could be to save a certain amount of money for a holiday or new outfit, it could be reduce your outgoings or to plan for early retirement, whatever these goals are they do not need to be rigid but to have a plan in place will certainly help you achieve them quicker.

Know your accounts

Make a list of ALL your accounts. Often people will have accounts here, there and everywhere. One from when they were a child, a bank account they opened as a student with a great over draft that they never closed, one where the wages go and maybe even a joint one. Once you know all your accounts close any that you don’t need, don’t use, and that don’t offer any benefits to you and then choose accounts that do work for you. Do your research and if you need a savings account find one that has the best rates or access to funds that works for you so you know exactly where your money is, what it is doing and how obtainable it is. You never know, by tracking down all your old accounts you may discover some money you had forgotten about.

Invest

Once you have completed the budget planner, have made any adjustments to your outgoings that you wish to make and worked out what money is surplus each month you need to look at how this money can best be used. Can you make an overpayment on the mortgage each month? Do you have a saving account it can be transferred to? or could it be invested? There are lots of ways to invest, some very simple, some a little more complex so again do your research. If you want something quick, simple and low risk then premium bonds are worth looking at . You can invest from as little as £25 up to £50,00 and each month you have the chance to win a prize valued between £25 – £1,000,000, of course you could win absolutely nothing but you also can’t loose anything either unlike if you invest in shares so it really depends what you are looking for.

I hope these 5 top tips on how to budget will help get you started and that you now feel a little more confident moving forward. If you have any top tips you would like to share then please do comment below with them.